Friday Features

On Fridays we will feature information on keeping your information secure. Navigate to the link above for more information provided by the American Bankers Association.

February 17, 2023

Top 10 List of Scams of 2023

By: ConsumerFraudReporting.org

- Identity Theft, Phishing and Pharming

Usually a scammer sends an email, a text message or calls your phone and pretends to be some organization, company or person you trust. Scammers gain access to your confidential information, like social security numbers, date of birth and then use it to apply for credit cards, loans and financial accounts. Typically, the victim receives an email that appears to be from a credible, real bank or credit card company, with links to a website and a request to update account information. But the website and email are fakes, made to look like the real website. - Phone scams

This includes telemarketers violating the Do Not Call list, Robodialers, scammers calling up pretending to be from a bank or credit card company. The National Do Not Call Registry (U.S.) or the National Do Not Call List (Canada) offer consumers a free way to reduce telemarketing calls. Scammers call anyway, of course, and they’ve even found a way to scam consumers by pretending to be a government official calling to sign you up or confirming your previous participation on the Dot Not call list! A good example of this is the “Your Microsoft license key has expired” scam call– which you can hear and read about on this page. - Debt Collection:

Most of the complaints under this category involve debt collectors. Consumers tell of receiving calls from harassing collectors who are threatening and will repeatedly call attempting to collect a debt. Other complaints that fall under this category involved credit/debit card fees, pay day loans, credit repair companies and unauthorized use of credit/debit cards. Some of these complaints involved hidden fees and billing disputes as well. - Fake Government Officials

If you received an email, letter, or phone call from a government agency (typically the IRS or FBI) and it instructs you to wire, Western Union or MoneyGram money someplace, or follow a link and enter information – don’t believe it! The U.S. government would never instruct anyone to use those methods to pay any bill or carry out a financial transaction, particularly with an overseas bank or agency. - Scam Text Messages– It looks like a text alert from your bank, asking you to confirm information or ‘reactivate your debit card’ by following a link on your smart phone. But it is just a way to steal personal information.

- Loans Scams / Credit Fixers

False promises of business or personal loans, even if credit is bad, for a fee upfront. Or a scam that promises to repair your credit for a fee. - Fake Prizes, Sweepstakes, Free Gifts, Lottery Scams

You receive an email claiming you won a prize, lottery or gift, and you only have to pay a “small fee” to claim it or cover “handling costs”. These include scams which can go under the name of genuine lotteries like the UK National Lottery and the El Gordo Spanish lottery. Unsolicited email or telephone calls tell people they are being entered or have already been entered into a prize draw. Later, they receive a call congratulating them on winning a substantial prize in a national lottery. But before they can claim their prize, they are told they must send money to pay for administration fees and taxes. The prize, of course, does not exist. No genuine lottery asks for money to pay fees or notifies its winners via email. - Internet merchandise scams

You purchase something online, but it is either never delivered or it is not what they claimed it was, or is defective. Online, and other shop from home, such as catalog, mail and phone shopping scams are on the rise. - Automobile-Related Complaints

Car loans, car buying, car sales, auto repair, fake or useless extended warranties. Some of the complaints alleged consumers paid for repairs and that services provided were shoddy. Consumers reported repair companies that return vehicles to the consumer in a worse condition than how it was initially given to them. Other complaints involved consumers not receiving title to their vehicles at the time of sale. - Fake check payments

You sell something online or through Craig’s List Consumers and you’re paid with phony checks, and instructed to wire money back to buyer. The check looks real… but after you try to cash it, you find out it is a fake; and you’re arrested for passing a counterfeit check! Read more about scam checks on this pageand here about the eBay check scam.

February 3, 2022

Reporting elder financial abuse

Information from the Consumer Protection Financial Bureau

Financial abuse is when someone takes or misuses another person’s money or property for the benefit of someone other than that person. For example, neighbors, caregivers, professionals and even family or friends may take money without permission, fail to repay money they owe, charge too much for services or not do what they were paid to do.

Financial abuse—sometimes called financial exploitation—is a form of elder abuse.

As a family member or friend, you are in a unique position to help protect your loved ones from financial abuse.

If you suspect elder financial abuse, report it to Adult Protective Services (APS). They serve older adults and adults with disabilities who need help due to abuse, neglect, or exploitation. Adult Protective Services is a common term and in Kansas, it is an office housed within the Department for Children and Families (DCF).

If you suspect an urgent risk of harm to your loved one or someone else, call 911 right away. Otherwise, you can call the non-emergency number for your local police or Sheriff’s office to file a report. Some state laws define elder financial abuse as a specific type of crime. Financial abuse may also involve other crimes such as theft, fraud, forgery, embezzlement, or money laundering.

You can also report financial abuse to your district attorney’s office.

Finally, contact the bank that carries the accounts related to the suspected financial elder abuse. With permission, they can take steps to restrict account usage and help keep track of any unusual activity.

At The Citizens State Bank, call us at 620-345-6317.

Above all else, whether or not you believe there is an urgent risk of danger to your loved one or someone else, report your concerns right away. Every step you take today, helps reduce future abuse.

January 27, 2023

Publishers Clearing House Scams – Click on the description to learn more.

January 13, 2023

This online survey scam is delivered through email, web pages, digital ads or as a text messages. To get people to take the bait, scammers typically inform potential victims that completing the survey will earn them rewards, such as a sweepstakes entry, possibly to win a trip or cash prize. Other rewards can be a popular product, such as an iPhone or a gift card.

One person said he saw a survey for Ace Hardware. If he took the survey, he could get a Stanley tool kit for just the price of shipping.

The scam occurs when a person enters his debit or credit card information to pay the shipping costs. The first charge is usually under $10. However, unfortunately, people often do not read the full terms and conditions when authorizing that initial shipping transaction. They unknowingly sign up for a subscription for sweepstakes entries, which creates ongoing transactions to their debit or credit cards.

If this happens to you, your debit/credit card must be closed.

If you’re a victim, our bank always encourages you to contact the company at the phone number tied to the transaction. Then, we can help file a dispute.

Remember, scammers want to trick you through opportunities too good to be true. Always be vigilant.

December 16, 2022

Play-by-play of a real scam on a bank customer

A customer received a phone call from a scammer saying they were from our bank. He advised that there was something wrong with an account.

Prior to that telephone call, the customer had somehow been coerced into giving out his credentials and one time passcode. The scammers were able to access his account and made a $10,000 transfer from savings into his checking account. As the scammers and customer discussed the issue, the customer was instructed to withdraw the $10,000 from checking and deposit the cash into a Bitcoin ATM located at a local gas station. The customer was told that this was the safest way to correct the error because funds would be insured.

As they continued with the ruse, the scammers also got the customer to buy $1,000 in Target gift cards.

This is a good example of why you should always take time to consider whether you should give out any credentials or be extra cautious about transacting large amounts of cash.

IF YOU’RE IN DOUBT, PLEASE REACH OUT. WE’RE HERE FOR YOU.

December 9, 2022

Protecting yourself at home

1. Store your sensitive documents in a secure location or safe.

2. Never provide passwords, PIN numbers, account numbers, etc., over the phone or via text messages or email.

3. Never send PINs (personal identification numbers), credit card numbers, passwords or personal/financial information in a text message or email.

4. Sign up for additional safeguards to protect your accounts.

5. Keep your contact information up to date.

6. When creating PIN numbers, make them difficult to guess and don’t use birthdates, phone numbers, address, etc.

7. Never write down your PIN to remember it.

8. Avoid using your cards at gas station pumps or outside ATMs.

9. Go paperless. We offer e-statements to help protect you from sensitive information getting into the wrong hands.

10. Shred ALL documents containing financial information.

November 18, 2022

Email Scams

Email scams account for 96 percent of all attacks on a person’s confidential information, making email the most popular tool for bad guys. Often, the scammer disguises an email to look and sound like it’s coming directly from the bank.

- Avoid clicking suspicious links. If an email pressures you to click on a link, whether to verify your login credentials or make a payment, you can be sure it’s a scam. Banks never ask you to do that. It’s best to avoid clicking links in an email. Before you click the button, hover your arrow over the link to reveal where it really leads. When in doubt, call us directly, or visit the website by typing the URL directly into your browser.

- Raise the red flag on scare tactics. Banks never use scare tactics, threats, or high-pressure language to get you to act quickly, however scammers will. Demands for urgent action should put you on high alert. No matter how authentic an email appears, never reply with personal information like your password, PIN, or social security number.

- Be skeptical of every email. Always treating incoming email as potential risk will protect you from scams. Fraudulent emails can appear very convincing, using official language and logos, and even similar URLs. Always be alert.

- Watch for attachments and typos. Your bank will never send attachments like a PDF in an unexpected email. Misspellings and poor grammar are also warning signs of a phishing scam.

What to do if you fall for an email scam

- Change your password if you clicked on a link and entered any personal information like your username and password into a fake site.

- Contact the bank by calling the number on the back of your card.

- If you lost money, file a police report.

- File a complaint with the Federal Trade Commission or call 1-877-FTC-HELP (382-4357).

IF YOU’RE IN DOUBT, PLEASE REACH OUT. WE’RE HERE FOR YOU. (620) 345-6317

November 11, 2022

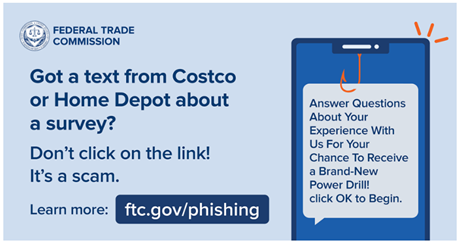

TEXT MESSAGE SCAMS

Phishing text messages attempt to trick you into sharing personal information like your password, PIN, or social security number to gain access to your bank account. If you don’t respond to these messages and delete them instead, your information is safe. All you need to do is spot the signs of a scam before you click or reply.

- Slow down—think before you act: Acting too quickly when you receive phishing text messages can result in unintentionally giving scammers access to your bank account — and your money. Scammers want you to feel confused and rushed, which is always a red flag. Banks will never threaten you into responding or use high-pressure tactics.

- Don’t click links: Never click on a link sent via text message — especially if it asks you to sign into your bank account. Scammers often use this technique to steal your username and password. When in doubt, visit your bank’s website by typing the URL directly into your browser or login to your bank’s mobile app.

- Never send personal information: Your bank will never ask for your PIN, password, or one-time login code in a text message. If you receive a text message asking for personal information, it’s a scam.

- Delete the message: Don’t risk accidentally replying to or saving a fraudulent text message on your phone. If you are reporting the message, take a screenshot to share, then delete it.

What to do if you fall for a phishing text message

- Change your password if you clicked on a link and entered any sort of username and password into a fake site.

- Contact your bank.

- If you lost money, file a police report.

- Report the scam to the Federal Trade Commission or call 1-877-FTC-HELP (382-4357).

If our card fraud system detects possible fraudulent card activity, it may Text, Call or Email you.

If a text is received, the system will give the last 4 of the card number in question, list the transactions in question and only have you reply yes or no, if the transactions are authorized.

If a call is received, the system may have you validate your date of birth or zip code, it will then have you use your keypad to respond to the validity of the transactions from the last 4 of the card and recent transactions in question

An email will be sent if the text or phone call has not been responded to within an hour. The email will list the last 4 of the card as well as transactions in question and give an option for you to choose whether the transactions in question are authorized.

We will never ask the entire card number, 3 digit CVV code from on the back of your card, or your account number when verifying potentially unauthorized transactions

IF YOU’RE IN DOUBT, PLEASE REACH OUT. WE’RE HERE FOR YOU.

November 4, 2022

PHONE CALLS

Scammers sometimes try to cheat you out of your money by impersonating your bank over the phone. In some scams, they act friendly and helpful. In others, they’ll threaten or scare you. Scammers will often ask for your personal information or get you to send them money. Banks never will.

Don’t rely on caller ID. Scammers can make any number or name appear on your caller ID. Even if your phone shows it’s your bank calling, it could be anyone. Always be wary of incoming calls.

Never give sensitive information. Never share sensitive information like your bank password, PIN, or a one-time login code with someone who calls you unexpectedly —?even if they say they’re from your bank. Banks may need to verify personal information if you call them, but never the other way around.

Watch out for a false sense of urgency. Scammers count on getting you to act before you think, usually by including a threat. Banks never will. A scammer might say act now or your account will be closed, or even we’ve detected suspicious activity on your account do not give in to the pressure.

Hang up — even if it sounds legit. Whether it’s a scammer impersonating your bank or a real call, stay safe by ending unexpected calls and dialing the number on the back of your bank card instead.

What to do if you fall for a scam email, call, or text.

Contact your bank, financial institutions, and creditors.

- Speak with the fraud department and explain that someone has stolen your identity

- Request to close or freeze any accounts that may have been tampered with or fraudulently established.

- Make sure to change your online login credentials, passwords, and PINs.

Secure your email and other communication accounts.

Many people reuse passwords and your email or cell phone account may be compromised as well.

- Immediately change your accounts’ passwords and implement multi-factor authentication — a setting that prevents cybercriminals from accessing your accounts, even if they know your password — if you haven’t already done so.

Check your credit reports and place a fraud alert on them.

- Get a free copy of your credit report from annualcreditreport.com or call 877.322.8228.

- Review your credit report to make sure unauthorized accounts have not been opened in your name.

- Report any fraudulent accounts to the appropriate financial institutions.

- Place a fraud alert on your credit by contacting one of the three credit bureaus. That company must tell the other two.

- Experian: 888.397.3742 or experian.com

- TransUnion: 800.680.7289 or transunion.com

- Equifax: 888.766.0008 or equifax.com

- File a complaint with the Federal Trade Commission or call 1-877-FTC-HELP (382-4357)

October 28, 2022

PHISHING

“Americans lost $5.8 billion to phishing and other fraud in 2021, a 70% increase from 2020.” — Federal Trade Commission

phish*ing (fiSHiNG) NOUN — Phishing is a fraudulent practice of sending emails purporting to be from a reputable company. These try to induce individuals to reveal personal information, such as passwords and credit card numbers.

Email scams account for 96 percent of all phishing attacks, making email the most popular tool for the bad guys. Often, the scammer will disguise the email to look and sound like it’s from your bank.